Capital One’s Small Business Cards have two fundamental problems even though it drives well over $100B in purchase volume:

The business can no longer compete in the market on rewards alone.

Interchange fees are being driven down my market forces. It’s a race to the bottom.

My team is responsible for designing zero-to-one products, maturing and scaling launched products, optimizing for the enteprise, and design a new business home that integrates them all together seamlessly.

two big Business goals:

Drive customer “stickiness” and retention

Launch new flagship capabilities to small business

three portfolios:

Create a new Business Financial Hub

Launch Flagship products

Enabling capabilities (Payments as a Service)

INTEGRATED BUSINESS HOME

The challenge: The current home page for Capital One is consumer-focused and consumer driven.

There is no real-estate for business products or marketing on the home page.

Business products are found through a “junk drawer” on the credit card page. The card page is largely owned by consumer enterprise.

THE OLD CARD PAGE:

- Credit card transactions only

- Business products buried in a junk drawer

Q1 2024 VISION CONCEPT:

- Seamless navigation between business cards and products

- Integrated insights and actions

- Dedicated business marketing space.

LAUNCH (Q1 2025)

- Designed leveraging updated design system direction

- Establishes new real-estate for driving onboarding, product adoption, and marketing

TABBED NAVIGATION: PROVE OUT ELEVATING FUNCTIONALITY AND REAL ESTATE NEEDS (Q1 2024)

THE CHALLENGE: IMPROVE FINDABILITY WITHOUT IMPACTING SATISFACTION

TABBED NAVIGATION DROVE:

- 5-14x increased engagement of key features

- I established the idea of “do no harm metrics” for this and each subsequent feature launch which to measure potential negative impacts to key features. In this case we measured very small drops in account closings and balance transfers

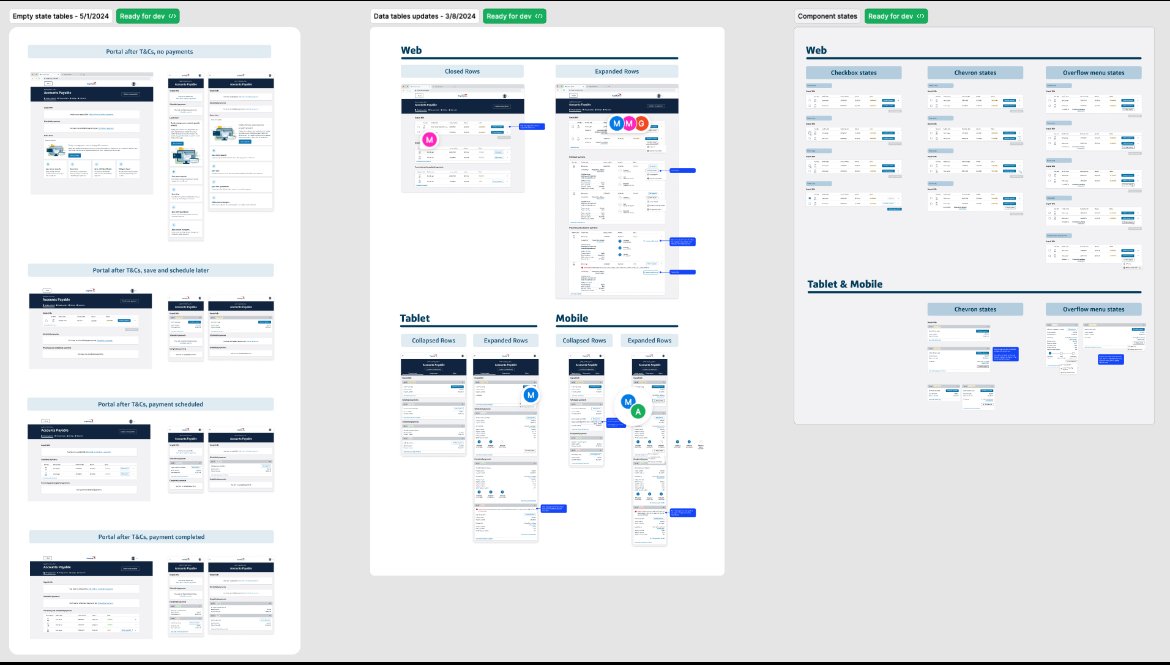

ACCOUNTS PAYABLE: build out an enrollment, landing, and Capital One experience for paying business invoices across multiple channels (2023-2024)

Additional research and functionality:

- Rebrand based on research underscoring mental model needs

- New home page to schedule and see payments statuses

- New payment channels and functionality like batch payments

Creating a new landing experience post MVP drove:

- 31% increase in accepting T&Cs

- 30% increase in purchase volume

- 12% increase in MFA success rates

- 3% increase in first-time payments

- Transaction volume increase from $475M in 2023 to $1.6B in PVOL in 2024

- UXUM-lite score of 85+

EXPENSE MANAGEMENT: Building on Accounts Payable’s success, launch a new Expense Management Product (Pilot launch in August 2024)

The challenge: apply learnings from accounts payable to create consistency and build out a fully new enrollment flow

Expense management has resulted in:

- 22% MoM growth

- 12.6% YoY spend lift

- Customers who spend 4.4x more than non-EM accounts

- FastCo nomination and submission in 2025

CARD ACCEPT: Leverage AI/ML to predict a merchant’s willingness to access card payments over alternative payment rails (Launched 2024, [images were deemed too sensitive])

the challenge: PREDICT CARD REWARDS AND SPEND POTENTIAL WITH AI/ML WITHOUT MISLEADING PROSPECTIVE CLIENTS OR THE SALES TEAM.

- $2.25B YTD spend identified in first two months with only 17% of sales team engaged

- 86% of field team would recommend to others

- $30B+ potential spend submitted since launch from sales team — with direct to customer pilot coming in Q2 2025.

- Leverages AI/ML based on multiple sources

- Sales team initial usage to drive customer conversion

- Future: embed in customer-facing Accounts Payable (Q2 2025)